Written by Dan Spacie, CEO of SCIRIS

Executive Summary

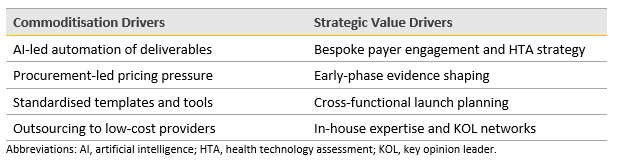

Market access services are undergoing a dual transformation. On one hand, technological advances and procurement pressures are driving commoditisation—standardising deliverables and compressing margins. On the other, the strategic value of market access is rising, especially in complex therapeutic areas and early-stage commercialisation. This paper explores the tension between these forces and outlines SCIRIS’s strategic response.

The Commoditisation Imperative

Commoditisation is driven by:

-

- Procurement-led contracting: Increasing reliance on reverse auctions, rate cards, and bundled service agreements.

- Artificial intelligence (AI) and automation: Tools that streamline evidence generation, pricing simulations, and dossier production.

- Standardisation of outputs: Global value dossiers, health technology assessment (HTA) templates, and pricing matrices are increasingly viewed as interchangeable.

These trends are reshaping client expectations, particularly in large pharma, where cost-efficiency and scalability dominate decision-making.

The Strategic Value of Market Access

Despite commoditisation, strategic market access remains indispensable:

-

- Early engagement: Aligning clinical development with payer expectations is critical to launch success.

- Complex HTA navigation: Tailored strategies for National Institute for Health and Care Excellence (NICE), Scottish Medicines Consortium (SMC), and European Union (EU) bodies require deep expertise and bespoke modelling.

- Cross-functional integration: Strategic market access bridges regulatory, health economics and outcomes research (HEOR), and commercial planning.

Clients increasingly recognise that strategic input—especially in rare diseases, cell/gene therapies, and multi-indication assets—can materially impact asset valuation and uptake.

The Conflict: Efficiency vs. Expertise

This tension manifests in several ways:

SCIRIS’s own experience—through Source Health Economics and Porterhouse Insights—shows that while clients seek efficiency, they also demand strategic depth.

SCIRIS’s Strategic Response

To reconcile these forces, SCIRIS is pursuing a combined strategy:

-

- Championing early engagement: Engaging with companies earlier in the development lifecycle enables deeper strategic alignment, faster market access planning, and stronger influence over evidence generation and value positioning.

- Driving patient involvement: Engaging with patient groups early in the development lifecycle ensures that treatments are shaped by real-world needs, improves trial design and recruitment, and builds trust and advocacy that can accelerate access and adoption.

- Segmenting services: Commoditising repeatable tasks (e.g. dossier formatting) while preserving strategic advisory as premium offerings.

- Investing in AI tools: Launching an AI commercialisation planning platform by mid-2026 to augment—not replace—strategic input.

- Expanding capabilities: Pursuing talent to deepen strategic expertise and geographic reach.

- Educating Clients: Positioning strategic market access as a value driver, not a cost centre, especially in investor and business development discussions.

Recommendations

-

- Internal: Continue to build differentiated capabilities in pricing, HTA strategy, and early-phase planning. Avoid over-reliance on commoditised service models.

- Client-facing: Educate clients on the return on investment (ROI) of strategic market access. Use case studies to demonstrate impact on launch success and asset valuation.

- Investor-facing: Highlight strategic market access as a growth engine in SCIRIS’s portfolio, especially in light of AI integration and geographic expansion.

Conclusion

Commoditisation is inevitable—but strategic market access is irreplaceable, especially with the drive towards more complex therapies. Source Health Economics’ and SCIRIS’s ability to balance efficiency with expertise will define our competitive edge in a rapidly evolving landscape.